We recently held a virtual breakfast focusing on all things money, hosted by the wonderful Lisa Conway-Hughes, aka Miss Lolly.

Lisa is a fellow of the personal finance society and works with around 300 clients advising them what to do with their money. Her alter-ego, Miss Lolly, works with women on their money issues and her She’s On The Money website houses her regular podcast and courses such as her 6 week Money Bootcamp.

It was a fantastic session with Lisa – thank you to those that attended. Here is a taster of what she guided us through.

Lisa started off the session by showing us two pictures – one of someone very nervous and one of someone uber confident and asked the attendees, ‘how do you feel about money?’

Answers that came back included: feeling nervous around it, not organized and uncomfortable talking about it.

Lisa stated reactions like this was the whole reason she started She’s On The Money, as women have less confidence about money. There’s not only the gender pay gap, but the gender investment gap as women have a fifth of the pension of men and when women invest, they see it as the family’s money, when men invest, they see it as their money.

Lisa shared with us that 70% self-employed people don’t have a pension but there is good news in that when women do invest, they outperform men.

Our Money Mindset

Most of being good finically comes from your money mindset. Lisa shared how she had recently hosted a session with a money coach and was really surprised at the answers the audience gave. The money coach posed the question: ‘if money came on a night out, what would it look like and be like?’

Lisa said hers would be a fun person, one to hang out with. But with over 100 women in the room, most of them described money as a party pooper wearing a grey suit in the corner.

Our money mindset starts as early as 7 years old so it is worth thinking about how your household was growing up about money. Were there arguments about money? Were there preconceptions about money?

When it comes to money, fundamentally it is as a tool to get what you want out of life.

Budget Planning

Lisa set the challenge of what excites and motivates us so we can start to work towards the goal we want.

She said to start with a budget planner (which can be downloaded from the Miss Lolly website) and she advised to do one for now, and then do one for when we retire. What people really underestimate is that you will spend a lot more when you’re retired. When working on end goal, don’t let your money mindset hold you back. Dare yourself to push what you really want when it comes to money and really visualize what will your lifestyle look like in the end.

When put through budget planner – this will give you the figure that you need and for every £10k you want in retirement, you need £250k in assets.

The most common amount of money Lisa gets asked for, for a couple, is between £60-£70k a year. So, working towards £1.5m of assets to achieve this.

Lisa then used the figure of £1m as the number to get you where you want to be. That million is savings, investment, pensions but is definitely not your home. Your home can’t create you an income while you are living in it.

The way you work it out to get your number (savings, pensions, investments) and then multiply it by 25 and that’s your end number.

The next thing to do is work out where you are now. This can be a bit tricky to do especially for people that like to bury their head in the sand. From the Miss Lolly website, you can download a form to start with.

If you get to know this number and get familiar with it, this will feed into your business and subliminally help how you run your business.

Lisa said that most people who come to her have disposable income but haven’t saved a lot. Then they have a really good look at what’s been spent socially – that’s the insight into where the money is going.

If you are doing this now, don’t look at your figures in lockdown as this isn’t representative of what you would normally spend. Go to last year, download Jan – Dec bank statements and add it all up and that’s what you spent on ‘extras’ such as socialising, travel etc. The figure in there in black and white and there is no ambiguity.

We all need to know exactly what we’re spending. There is a fantastic book by David Bach called Automatic Millionaire that Lisa recommends. He was a financial advisor in the US and worked with a couple on average incomes but by doing things right every month financially saw them become millionaires.

Pay yourself method first

What normally happens is that when money comes in on monthly basis, all the bills go out, and then life happens and whatever is left gets saved. However human nature means if it’s there we spend it which results in minimal savings or no savings at all.

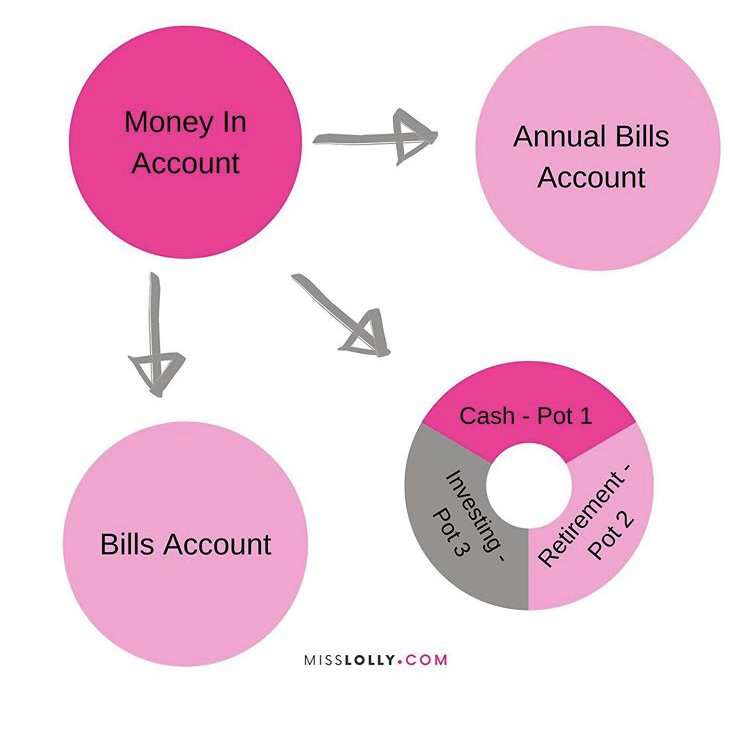

The pay yourself first method means that on the day you get paid is when all your direct debits go out, but not just bills and mortgage, but for pot 1, pot 2 and pot 3.

Pot 1: Cash savings

Pot 2: Retirement planning

Pot 3: Investments

If you do this, automatically you are doing the right things financially, but the hard bit working out what these numbers should be.

Money in. If not yet in a position where your business pays you the same each month, a good idea is to sit with your accountant and try and prevent these roller coasters and have stability in terms of how much you are getting paid and maintaining a steady income.

Lisa said that she tends to find people with smaller businesses who are perhaps on this payment roller coaster can manifest a negative mindset around money as they don’t feel in control of it. During lockdown, it is maybe an ideal opportunity to build up reserves in your business while expenditure is low.

When doing your budget planner, there is a column of all things you spend on a monthly basis, then a column on annual basis such as holidays, Christmas and taxes.

If you add up the annual column and it is £6k for example, then you then know that you need to pay in £500 a month into an annual bills account to cover this. That means the money is already there and accounted for. The hardest bit is the beginning, but do start and set aside monthly amount. In a year’s time, it will feel great.

On the day you get paid – there should be money going out into pot 1, pot 2 and pot 3. But always make sure pot 1 is filled before you touch pot 3. The cash pot should have in it 3-6 months in outgoings in cash at any one time and this can be kept in your business account if you need to also. This is for the rainy day, so if something happens or there’s an emergency – this is the pot you go to and you can use the money guilt free as that’s what it’s there for.

Pot 2 is your pension and pot 3 in your investments, so an investment ISA for example. Lisa shared with us that each weekend the money section of the newspapers list where the best savings accounts are currently so it is worth checking them out and keeping up to date with the recommendations.

Please do follow Miss Lolly and the She’s on the Money podcast for more information on this. A huge thank you to Lisa for sharing her fantastic knowledge!